The Bank of England signalled that Britons should not expect interest rates to come down soon, after they were held for the third time in a row.

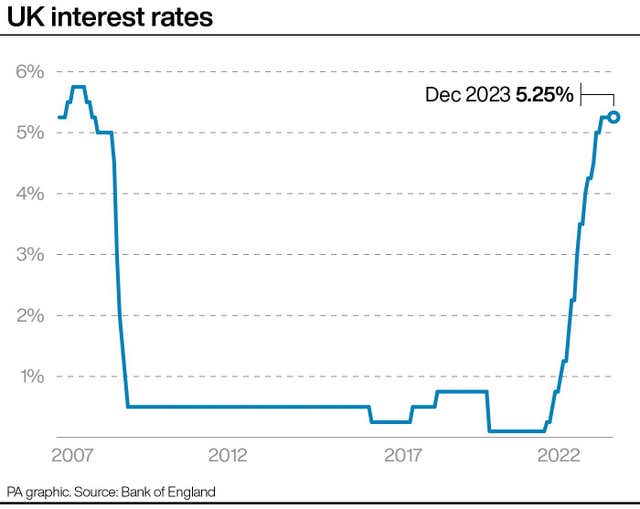

On Thursday, the Bank’s Monetary Policy Committee (MPC) voted in favour of keeping the rate steady at 5.25%, which is a 15-year high.

Governor Andrew Bailey said after the decision that there is “still some way to go” in policymakers’ efforts to get inflation down.

The central bank also said monetary policy is likely to remain “restrictive for an extended period of time”, contrasting with the message from the US central bank on Wednesday that it is hoping to cut rates next year.

The cautious tone also appeared to pour cold water on comments from Prime Minister Rishi Sunak earlier on Thursday that borrowers can start looking towards a reduction in their mortgage rates.

Six members of the nine-strong committee were in favour of maintaining the rate at 5.25%, while three called for an increase to 5.5%.

Interest rates remain at 5.25%. Andrew Bailey explains the decision of the Monetary Policy Committee below. pic.twitter.com/ZMXKHMHTn2

— Bank of England (@bankofengland) December 14, 2023

The interest rate – which helps dictate mortgage rates from banks – had been set at 5.25% in previous meetings in September and November, following 14 consecutive increases.

The cost of borrowing was raised in a bid to tackle soaring inflation, which peaked at 11.1% last year, in order to bring it closer to the Bank’s 2% target rate.

Financial markets have increasingly priced in substantial rate cuts next year after recent economic data pointed towards slower wage increases and pressure on economic growth.

This week, the Office for National Statistics revealed that regular earnings, excluding bonuses, rose by 7.3% in the three months to October, down from 7.8% in the previous three months.

Meanwhile, it also reported that UK gross domestic product (GDP) fell 0.3% in October.

On Thursday morning, the markets indicated that they expect the UK’s interest rate to drop to 4% by the end of next year.

However, in its latest report the Bank’s MPC appeared cautious over the potential for cuts soon.

“The committee continues to judge that monetary policy is likely to need to be restrictive for an extended period of time,” it said.

“Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.”

Meanwhile, Mr Bailey also signalled that policy will need to remain stable to weigh further on inflation.

“We’ve come a long way this year, and successive rate increases have helped bring inflation down from over 10% in January to 4.6% in October, but there is still some way to go,” he said.

“We’ll continue to watch the data closely, and take the decisions necessary to get inflation all the way back to 2%.”

It was a more cautious message than that of the Prime Minister earlier on Thursday.

Prior to the rate decision, Mr Sunak said: “I’m really pleased that we have halved inflation from close to 11% down to just over 4.5% in the most recent numbers – so that’s real progress over this year.

“That’s already making a difference, I hope, to many people’s weekly shop, but will also mean that there’s no upward pressure, hopefully, on interest rates and people can start looking forward to their mortgage rates coming down over time.”

It comes around a week after the Bank of England warned that almost five million UK homeowners are still set to see their mortgage repayments jump by hundreds of pounds over the next three years.

The Bank’s latest decision came a day after the US Federal Reserve also held interest rates.

However, the Fed also pencilled in at least three rate cuts for 2024 after witnessing inflation draw nearer to target levels.

We kept our interest rates unchanged at our latest meeting.

See our monetary policy decisions https://t.co/whYDllDcVm pic.twitter.com/X1tGIEazzA

— European Central Bank (@ecb) December 14, 2023

On Thursday, the European Central Bank also held its interest rate.

The signals from the Fed that rate cuts could be on their way soon helped drive a strong session for equity markets, with the FTSE 100 up around 1.6% on Thursday afternoon as a result.

Meanwhile, the value of the pound jumped to a 10-day high of 1.27 US dollars after UK interest rates were held.

The committee said there is still pressure from services inflation, which is expected to temporarily increase next month and will need to abate in order to help reach the inflation target.

Bank staff also said the economy is expected to remain “broadly flat” in the final quarter of 2023, after GDP was also flat in the third quarter, meaning the UK would narrowly avoid a technical recession – two consecutive quarters of decline.

It said economic growth is also likely to be broadly flat in the “coming quarters” as higher borrowing costs put pressure on consumer spending.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here